The Road Back to £100K Starts Here

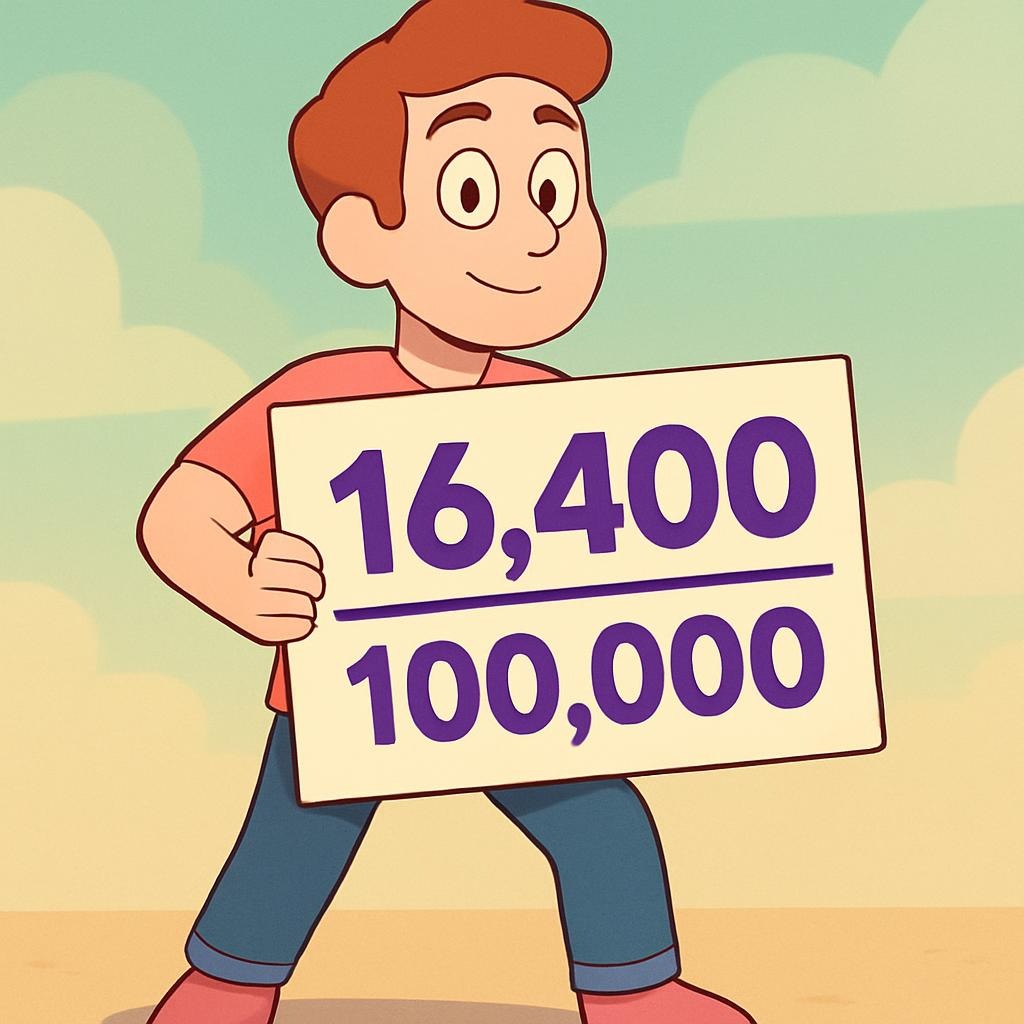

| October 5 2024 | July 7 2025 | Changes | |

| Assessable investments | £0 | £16,400 | +16,400 |

| Total Net Worth | £199,850 | £205,600 | +5,750 |

| Notes | Spent money | Made investments |

When Survival Mode Takes Over: Missing the Moment My Investments Hit Zero

Between changing nappies and discovering the magic of a dishwasher (which had been sitting in the kitchen for five-plus years…), I barely had time to notice my Stocks & Shares account had dropped to zero.

It wasn’t a crash or a panic — just the quiet cost of buying a flat. And adding a second loo. (Which, honestly, feels like a massive win.)

Sleep deprivation from a newborn had turned my brain into zombie mode. For about ten months, I didn’t really stop to think about what I was feeling or the fact my accounts had hit zero. I was just surviving. It wasn’t a crisis, but it felt like a long walk in the mist — a slow drip of life that just kept going, between piles of laundry and endless feeds.

I had a roof over my head, sure. But suddenly, the thing I had built up over years — those assets in my ISA and LISA — had gone poof. The tidy sums that felt like progress toward financial independence were gone. In their place: tiles, plumbing bills, and a very unromantic mortgage.

Feeling the Gap

Emotionally? It stung. I felt poor, despite technically being better off. I was paying around £100 less a month in rent, sure — but I was bleeding money on home improvements, baby stuff, and all the extras that come with having a newborn.

We made some tough choices, too. Dropping the cleaner seemed like a smart way to save — but it was a big mistake. A clean house really does make a happy home, and the stress of keeping up piled on. That kind of penny-pinching mood wasn’t great for my headspace.

At first, I barely registered my investment accounts hitting zero. No guilt, no frustration — just survival mode. But as the months passed, a sense of being behind settled in. Like starting over again, from scratch. It was frustrating and, honestly, a bit daunting.

Our builder was a perfectionist — I’d never seen such perfect tiling in my life. The second loo is a massive win (and no more cracks in the shower for us!!), but the money spent on those little luxuries made me feel conflicted — an internal tug-of-war between investing in environmental improvements and just saving that money outright. Spoiler: the environment won. Having to make design decisions — whether I liked it or not — meant I started to regain a sense of agency over my money and my life.

My motivation to invest again started to bubble up slowly. I remember the exact date — 5th October — when I finally opened a Vanguard account. Life was settling down enough for me to think about the future again. And after all the muddling through, it felt like the first step back uphill.

Starting Again (With Fewer Illusions)

So I’m back at it — seven months in now, and my little pot is sitting at £16,400. Not exactly fireworks, but it’s something. It’s growing. Slowly. Same game plan as before: I automate about 10% of my income into investing, which currently works out to around £220 a month, and invest as much as I reasonably can while still living a good, slow-ish life.

Why 10%? With all the new costs flying around — nursery fees, mortgage bits, nappies that seem to evaporate overnight — that’s the number I can commit to without resenting it. It’s the amount I can part with and still sleep well, still afford decent cheese, still grab the odd pub lunch.

The only manual bit is sweeping any leftovers at the end of the month into my investments. Some months it’s £100, some months it’s £12. It adds up, eventually.

No crypto. No hot tips. No influencer-endorsed index fund of the month. Just the boring, reliable stuff. Global trackers. Low fees. The equivalent of sensible shoes for your money.

There’s no dramatic pivot. No inspirational rebrand. Just a return to rhythm — quiet, steady contributions, and that long, slow climb toward the first £100K again. Because yes — the first £100K really is the hardest. It’s a grind. A test of patience more than skill.

But weirdly? I kind of love it. There’s something freeing about doing this all again — with fewer illusions and a lot less pressure. No more spreadsheets with 12 tabs. No more early retirement calculators. Just progress, one month at a time.

Letting Go of the Gloss

I’ve let go of a few stories this time around. Mainly, the idea that investing always has to feel empowering or exciting. Honestly, it just feels like brushing my teeth now. Boring is good.

That said, I do miss the excitement I used to feel. That sense of momentum, of watching numbers climb and goals inch closer. Maybe by documenting this new chapter, I can coax a bit of that spark back. It doesn’t have to be fireworks — just something to keep me feeling connected to the process.

I’ve also stopped believing that ‘success’ in investing looks a certain way — the spreadsheets, the FIRE milestones, the dream of quitting a job at 35 to live on a beach with a laptop. For me, it’s about options. It’s knowing I’m quietly building something in the background, even when life is busy and loud.

Right now, I’m torn between investing and paying off the mortgage faster. It’s a balancing act. I’ve got around £8,000 in cash — £3,000 for emergencies, £4,000 pre-saved for nursery fees (so I don’t panic later), and another bit tucked away for holidays and fun things I haven’t even thought of yet. Sometimes I wonder if I should just chuck more of that into investments — but honestly? Having the cushion helps me sleep better. Peace > optimisation.

Crunching the Numbers (or: How Long to £100K?)

Right now, I’m investing about £220 a month — that’s the automated bit, plus whatever I manage to sweep in at the end of the month. Just the slow, steady stuff. The kind of investing that doesn’t make headlines but does eventually add up.

Let’s say I stay focused on that nice, round £100K goal — not because money is everything, but because it feels like a marker of momentum. A quiet “you’re getting somewhere.” So, what does the maths actually say?

If I stay at £220/month (with a 6% return), I’m pacing toward:

- In 5 years: About £37,470

- In 7 years: Around £47,830

- In 10 years: Closer to £65,890

Steady, but definitely the scenic route.

If I wanted to hit that £100K goal faster, here’s what I’d need to invest each month:

- To hit £100K in 5 years: about £1,116/month

(Yes, my jaw dropped too — that’s basically a second mortgage and then some.) - To hit £100K in 7 years (when I turn 40): roughly £750/month

Still ambitious, but a bit less “panic spreadsheet at midnight.” - To hit £100K in 10 years: around £530/month

That feels more doable — a long game, but one with room to breathe.

So no, I’m not sprinting. I’m strolling. I’ve already done the all-in hustle years. This round, I’m choosing sustainable over impressive. I’ll celebrate each milestone along the way — even the quiet ones. The ones that come with a cup of tea, a line crossed off a spreadsheet, or just the satisfying click of another auto-transfer doing its job.

If You’re Hesitant to Start (or Restart)

When I first restarted investing after everything hit zero, the emotional hurdles felt real. It took me over 10 years to save £50–60K in my investment accounts — so now, facing the possibility of starting again? Yeah, it’s draining. There was a quiet sense of futility—like, “Why bother? I’ve lost ground.” But over time, I remind myself that my net worth isn’t just in my Stocks & Shares accounts; it includes property, pensions, and more—and all of that counts and deserves celebrating. That little mental shift helps me stay steady when the numbers on screen look a bit bleak.

What pushed me from “ugh, I have to start again” to “okay, let’s go” was surprisingly practical: Googling fees. I wanted to find the cheapest, most trusted place to park my money, and that nudged me to open a Vanguard account. Sometimes, it’s the small practical steps that break the inertia, not some grand motivational speech.

This second investing journey feels way more relaxed than the first. I’ve got automation in place, which means I don’t have to think too hard about timing or amounts. Now, it’s a delicate dance between investing and paying off the mortgage. And the biggest illusion I’ve let go? That this will be quick. It won’t be. This is a long game, slow and steady.

That slow and steady approach? It works. It’s not glamorous. It’s not fast. But it’s peace of mind in a world that often feels like chaos.

My Theatre-Loving Friend and the Power of Boring Investing

I’ve been chatting about money with one particular friend for over ten years — back to our graduate days when I’d peer over their bank statements, asking, “What’s this insurance you’re playing at? Go find out!” They saved a fair bit just by treating our conversations like informal financial audits. If I’m a level 30 financial expert, they’re a solid level 5 — but happier because their basics are rock solid: they audit, automate, and let their money work quietly in the background.

What surprised me most? They just stuck with it, quietly investing weekly without making a big deal out of it. I actually forgot about this until recently, and now I’m excited to catch up and see how it’s all going — and what their life goals are. Their approach? Simple, consistent, and automated — no drama, just action.

Their story is a great reminder that “boring” is great. Investing isn’t a flashy theatrical performance; it’s the background score that keeps the show running smoothly. Small, steady actions beat occasional, frantic bursts every tim

Mindset Shifts That Changed the Game

To anyone feeling like they’ve “missed the boat,” I say this: I never run for buses because I don’t want to miss them — but I’m definitely getting on the next one. And I’m not turning around to go home just because I missed the first. Financial journeys aren’t sprints or races; they’re about showing up and moving forward.

The biggest myth I believed about investing? That it’s a fast track to instant success or freedom. Dropping that belief felt like a weight lifted off my shoulders. Now, it’s just steady progress, not a dramatic leap.

This time around, I’m not obsessing over spreadsheets or constantly checking the market. Over-optimisation was exhausting, and now I’m better off ignoring the noise. The “boring” steady investing feels quietly powerful. It lets me focus on what truly matters — my family, my home, and building a balanced life.

Gentle Questions for the Road:

These days, I’m investing with far less fuss. I focus on the basics, trust the process, and try to tune out the noise. I’m not chasing financial independence at breakneck speed anymore — but I am still walking toward it, just in better shoes.

If you’re navigating your own version of “starting again,” maybe these questions will help:

- What made you pause (or stop) investing before — and is that still true now?

- What feels like ‘enough’ for you financially — not someday, but this year?

- If boring is sustainable, what would your most boring-but-steady investing setup look like?

- How do you balance investing goals with day-to-day life expenses and surprises?

- What small wins can you celebrate today, even if the big goals feel far off?

Here’s to the slow burn — and the quiet satisfaction of trying again.

There’s real power in starting over — especially when you know the road, and you’ve chosen to walk it at your own pace.