Paying yourself first isn’t about scrimping and scraping until you’re miserable. It’s about quietly telling your future self, “I’ve got you.” And that’s a message worth repeating, especially when life gets expensive and chaotic.

Here’s what I’ve been learning about this ancient but surprisingly modern habit…

Why This Matters

If you’re like most people, you probably save whatever’s left over at the end of the month. Spoiler: there’s rarely anything left. Saving last turns out to be saving nothing.

Paying yourself first flips the script. Instead of hoping for leftovers, you decide that your future deserves a slice of your income from the get-go. It’s an act of self-respect, not restriction.

Imagine being stuck in old age eating beans and rice out of a tin — a sad prospect, right? (Though, full disclosure: beans on toast is one of my favourite meals.) Now, imagine that could be your future if you don’t take your financial self seriously. Can’t picture it? Try tying your ankles together and walking stooped — that’s what looking after yourself might look like if you ignore paying yourself first.

This simple mindset shift builds momentum toward bigger goals — like financial independence, that elusive place where your investments cover your expenses and life feels less about worry and more about choice.

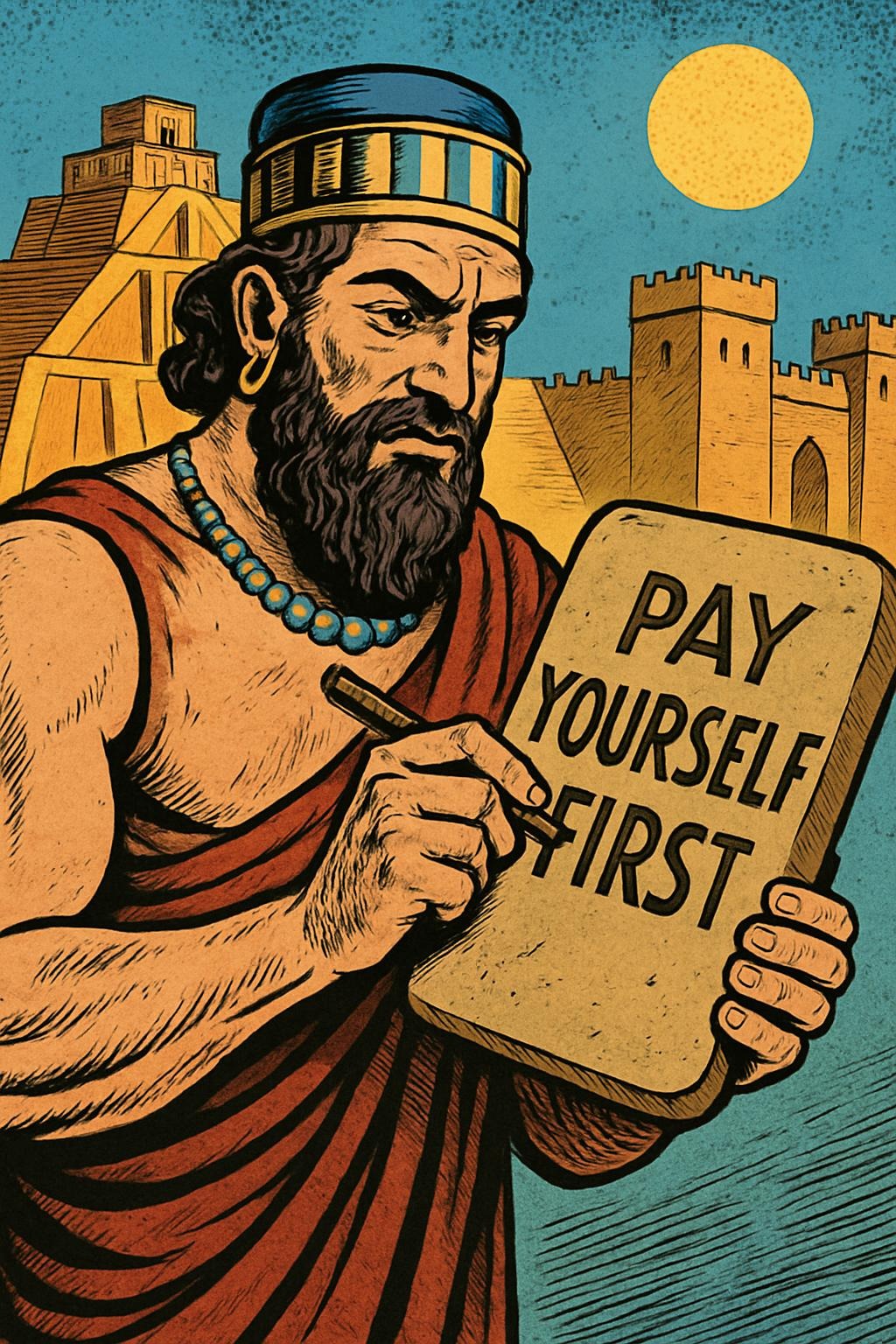

The 4000-Year-Old Wisdom

Long before contactless cards or online banking, the ancient Babylonians were the original money nerds — not the flashy types, but the practical, no-nonsense savers who knew their stuff. Around 4000 years ago, a man known as the richest man in Babylon laid down a timeless rule: set aside at least 10% of what you earn.

This wasn’t a suggestion for luxury — it was a simple formula for financial survival and eventual freedom. They understood that wealth wasn’t about how much you made, but how much you kept. Even in a world ruled by clay tablets and merchants, the principle of paying yourself first was sacred.

What’s remarkable is how their wisdom still rings true today. We have fancy apps and automated systems, but the core idea hasn’t changed: prioritise yourself first. The Babylonians showed us that the discipline to save a fraction of every coin could lead to prosperity, peace, and choice.

Today, automation makes this easier than ever. You can set it and forget it — letting your money grow quietly, steadily, just as those ancient sages intended.

Automation is King

In the UK, auto-enrolment pension contributions start at around 7%. That’s a solid baseline but probably not enough if you want to retire comfortably or reach financial independence faster.

I currently automate 10% of my net income into low-cost index funds. It’s a bit of a step down from the 40% I used to invest, thanks to expensive nursery fees, but it feels like a lifeline. I know this number will go up — it’s just taking a bit of time.

The real magic? This habit prevents lifestyle creep. When you get a raise, you can bump up your savings without guilt. Paying yourself first turns saving from a chore into a superpower — one that grows your peace of mind alongside your money.

What Happens When You Pay Yourself First?

It’s less about deprivation and more about honouring your future self. Saving feels less like sacrifice and more like self-care.

You’re not giving up your Friday night curry; you’re just making sure your future self won’t have to survive on beans and toast forever. Over time, this builds a healthy relationship with money — one that’s surprisingly addictive in a good way.

And when life’s expensive seasons come around? You scale down, not out. You keep the habit alive, even if it’s small for now.

Gentle Questions for the Road

Keeping this habit alive is a quiet act of kindness towards my future self. It’s not perfect, but it’s consistent.

- What’s your biggest hesitation about paying yourself first?

- How might starting a small, automatic saving habit change your peace of mind?

- What would it mean for you to think of saving as an act of self-respect, not sacrifice?

If paying yourself first feels tricky or strange right now, that’s okay — the important bit is you start, even if it’s just a little. After all, those ancient Babylonians were on to something.