January has a funny reputation. It’s meant to be about fresh starts, bold resolutions, and dramatic personal reinventions — but in reality, it’s often quieter than that. The lights come down, the calendar stretches out, and life gently returns to its usual rhythm.

This January felt less like a reset and more like a continuation. Longer days creeping back in. Five weekends that made the month feel oddly spacious. A sense of moving forward without needing to declare anything loudly.

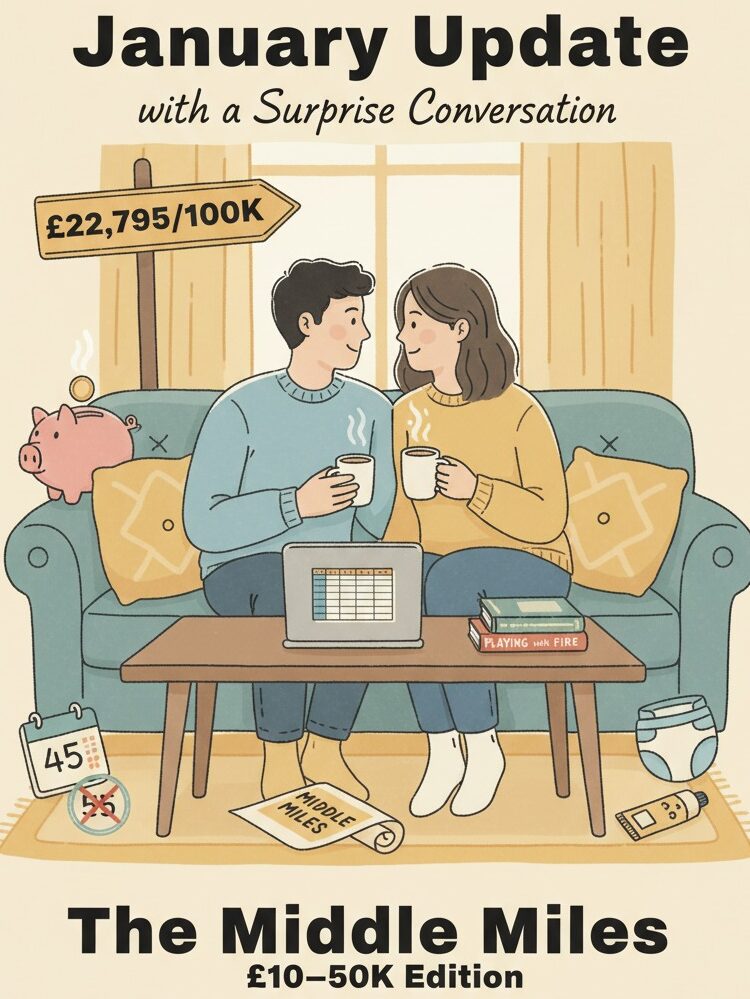

Which, honestly, feels like the right energy for this stage of the First 100K journey.

January, Without the Drama

There was no big financial overhaul this month. No new system, no colour-coded spreadsheet epiphany, no sudden urge to optimise everything into submission.

Instead, January arrived calmly. Life resumed. Work ticked along. Home felt steady. And the FI journey carried on quietly in the background — present, but not demanding centre stage.

I’m increasingly convinced this is how most progress actually happens. Not in bursts of motivation, but in months like this one. Ordinary. Slightly long. Gently productive.

Where the First 100K Stands (January Edition)

Let’s get the numbers out of the way early, before we drift too far into reflection.

- Opening balance: £22,133

- Investment deposit: £250

- Growth / shrink: +£412

- Closing balance: £22,795

No fireworks. No panic. Just a calm snapshot of where things landed by the end of the month.

The Middle Miles (£10–50K Edition)

This is very much the middle stretch of the journey — the part people don’t tend to write motivational posters about.

Systems are set up. Contributions are automated. The task now is mostly to keep going. Deposit the money. Live your life. Don’t sabotage yourself out of boredom.

It’s slow. It’s steady. And it’s surprisingly peaceful once you stop expecting it to feel exciting.

The adventure hasn’t stopped — it’s just happening at a human pace.

The Conversation I Didn’t Realise We Hadn’t Had

One of the most important moments this month didn’t involve spreadsheets or balances at all. It came out of a conversation with my partner — one we both assumed we’d already had.

We talk about money regularly. We have check-ins. We review spending. We plan for our home and our life together. I thought we were fully aligned.

Then, almost casually, I said I wanted to retire by 45.

There was a pause. Not a dramatic one — just the kind that tells you something new has landed.

They hadn’t known that.

Not because we don’t talk, but because we’d never explicitly talked about when we wanted to stop working. Their mental picture was closer to 55. Mine had quietly shifted to something earlier — with Barista FIRE in mind, working less rather than stopping outright.

No disagreement. No tension. Just surprise, followed by curiosity.

Alignment Is Something You Keep Returning To

It was a good reminder that alignment isn’t a box you tick once. You don’t “achieve” it and move on.

Even when you’re communicating well, there are still assumptions humming quietly in the background. Timelines. Imagined futures. Unspoken versions of “later.”

Saying it out loud changed something. Not the plan immediately — but the feeling. The sense that we were now looking in the same direction, properly, instead of roughly parallel.

From Individual Goals to Shared Direction

What followed was one of those subtle but meaningful shifts. The goal stopped being something I was holding privately and became something we were thinking about together.

Not identical goals — but compatible ones.

They’re aiming for something closer to stopping. I’m imagining a slower taper. Different shapes, same horizon.

We watched Playing with FIRE together — partly because I was excited and wanted to share it. It landed gently. Familiar faces. Human stories. A reminder that this isn’t about escaping life, but designing one that fits.

We didn’t rush to act on it. No spreadsheets opened mid-film. No sudden declarations.

We let it sit.

And that felt like progress in itself.

Keeping Money Simple (Even When You’re Both Nerds)

One thing that’s become increasingly important to us is simplicity — especially because we both like thinking about money. Which, paradoxically, makes it harder.

Right now, simplicity looks like this:

- One joint account

- Minimal movement

- Checking balances less often

Less fiddling. Less categorising. Less energy spent being “technically correct.”

The Nappies Conversation

A small example that stuck with me this month was a conversation about nappies and creams. Whether we should reconcile them across months. Whether they technically belonged in January or February’s budget.

We could have done that. It wouldn’t have been wrong.

But we didn’t.

Because in the long-term view, it doesn’t matter. And choosing simplicity over perfection is an active decision — especially when you’re both financial nerds with opinions.

The goal isn’t a flawless spreadsheet. It’s a life that feels manageable, calm, and aligned.

January, Softly Aligned

As the month came to a close, what stood out most wasn’t the numbers — it was the feeling.

Alignment changes the texture of things. It softens decisions. It makes long-term goals feel less heavy. It turns the FI journey from a solo project into a shared direction.

January felt long, but not difficult. Steady. Grounded. Gently optimistic.

No big declarations. No dramatic leaps. Just the adventure continuing — quietly, intentionally, and together.

Gentle Questions for the Road

There’s something powerful about shared clarity. Not the kind that demands action immediately, but the kind that settles in and slowly reshapes how you move through your days.

Financial Independence, at least in this season, doesn’t feel like an escape plan. It feels more like alignment work — choosing simplicity, having honest conversations, and letting progress unfold without forcing it.

That calm counts too.

So, a few gentle questions to carry with you:

- What money conversation are you assuming you’ve already had?

- Where could simplicity replace precision in your finances right now?

- What does “enough” look like for you in this season of life?

As ever, the First 100K journey continues — not loudly, not perfectly, but steadily. And for now, that feels like exactly enough.