I used to think tracking my money meant becoming a finance bro—all “Q4 projections” and “leveraging assets.” My life before burnout was all about optimization, and I applied that same exhausting energy to my finances. My spreadsheets had so many tabs and formulas they looked like they were trying to solve for pi, and honestly? It felt like another hustle.

So I pivoted. I needed a way to manage my money that felt like a quiet coffee morning, not a board meeting. The truth is, simple living isn’t about ignoring problems; it’s about facing them in the chillest, most low-key way possible. It’s about applying the KISS principle: Keep It Simple, Sweetheart.

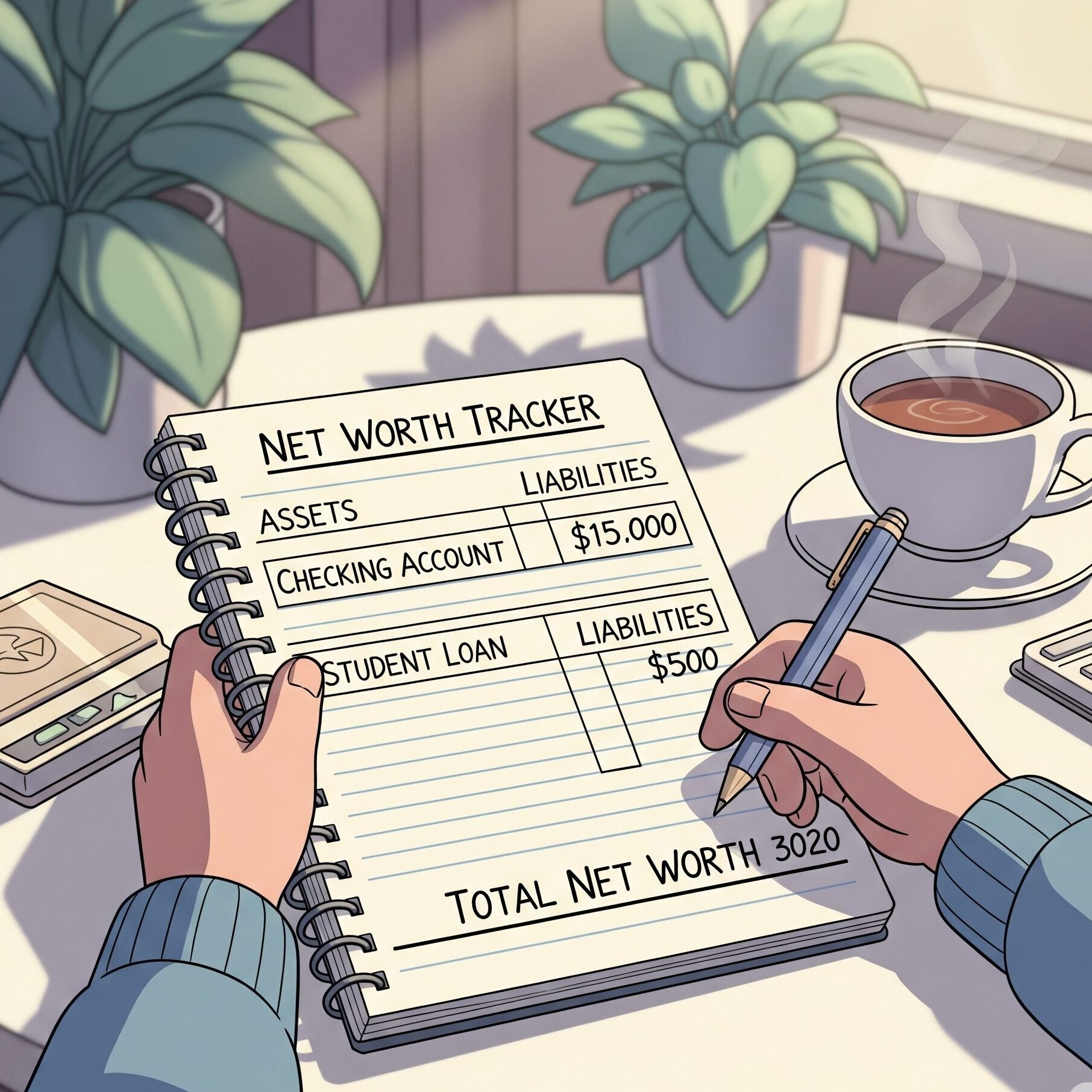

So, let’s talk about a net worth tracker. But let’s do it in a way that feels grounding and honest.

What’s a Net Worth Tracker?

Think of it as a financial selfie. It’s a snapshot of where you are right now. Not a judgment, just a picture. It’s a simple equation:

Assets – Liabilities = Net Worth

That’s it. K.I.S.S

Your assets are things that put money in your pocket or have value.

- Money in your bank accounts (checking, savings)

- Investments (retirement accounts, brokerage accounts)

- The value of your car or house (if you own it)

Your liabilities are things that take money out of your pocket.

- Credit card debt

- Student loans

- Your mortgage

- Car loan

You don’t need a fancy app or a spreadsheet with 50 columns. You can literally do this with a notebook and a pen. Just list your assets on one page, your liabilities on the other, and do the math. Just seeing the numbers on paper can be a huge relief, or at the very least, a clear starting point.

My Financial Selfie

To show you what I mean, here are my own numbers. I’m sharing them not to brag or complain, but to show you what a real, imperfect snapshot looks like.

My Assets (What I Own):

- Cash & Savings: £8,000 (just my checking and savings accounts)

- Investments: £15,600 in a Stocks & Shares ISA, £7,000 in a workplace pension, and £300 in some stupid individual investments that, hey, worked out okay (I got lucky).

- Government Pension: About £63,000 in what’s called a “commuted value”—this isn’t cash in my hand today, but it’s a valuable asset that will provide a future income stream of about £2,500 per year.

- My Apartment share: £158,000.

- Car: Zero. The buses are frequent enough for my chill-paced life.

My Liabilities (What I Owe):

- Credit Card: £20. (Yep, just twenty quid. I pay it off in full every month so it doesn’t become a thing.)

- Mortgage: £50,200, with 24.25 years left.

So, the simple math looks like this:

£251,900 (My Assets) – £50,220 (My Liabilities) = £201,680 (My Net Worth)

That’s my number. It’s not a finish line or a gold star. It’s just a number. It’s my starting point. My personal tracker shows the date, income, expenses, and this net worth number. You can put these numbers into a spreadsheet if you wish, or jot the number down in a cute little journal—just don’t overcomplicate it.

This whole process—this simple tracking—is not about perfection. It’s about presence. It’s about slowly, gently, and honestly getting to know your money so you can finally stop overthinking it. It’s a small, quiet step toward peace.

Leave a Reply